charitable gift annuity tax reporting

Schedule D must be completed. Charitable contributions to qualified tax-exempt organizations do not need to be disclosed on a gift tax return unless the taxpayer otherwise has a reporting requirement for other taxable gifts.

Charitable Gift Annuity The Physicians Committee

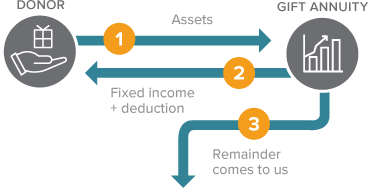

Depending on your tax bracket the type of asset and the type of charity the charitable deduction can reduce your income taxes by 10 percent 20 percent 30 percent or even more.

. A SPIA is a contract between you and an insurance company designed for income purposes only. Including a deduction for estate or gift tax purposes cannot have a total value of more than 60 of the total FMV of all amounts in the trust. Check the box reflecting the section under the Internal.

If in connection with a transfer to or for the use of an organization described in subsection c such organization incurs an obligation to pay a charitable gift annuity as defined in section 501m and such organization purchases any annuity contract to fund such obligation persons receiving payments under the charitable gift annuity. For 2019 the annual exclusion for a gift of a present interest is 15000. The Internal Revenue Service announced today the official estate and gift tax limits for 2021.

The estate and gift tax exemption is 117 million per individual up from 1158 million in. However many of these crowdfunding websites are not run by DGRs. Instructions and Packet pdf Instructions and Packet word.

For federal tax purposes this trust is treated as a grantor trust. Unlike a deferred annuity an immediate annuity skips the accumulation phase and begins paying out income either immediately or within a year after you have purchased it with a single lump-sum paymentSPIAs are also called immediate payment annuities income annuities and immediate. Schedule D Charitable Gift Annuity Certification.

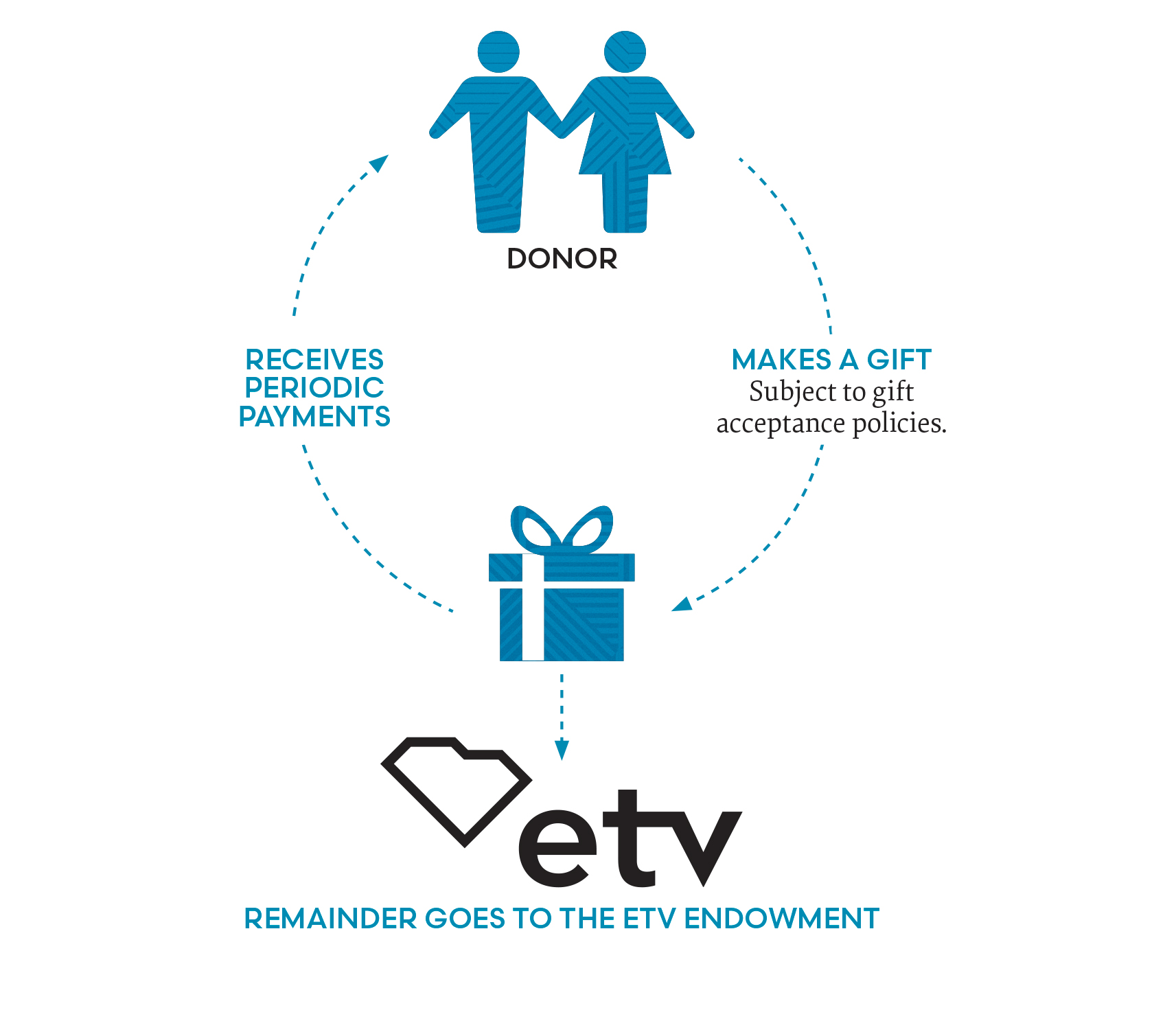

Charitable Gift Annuity Application Packet ONLINE Charitable Gift Annuity Issuer Annual Report Form. The donor gives a large amount of money to the nonprofit. Health Carrier Grievance Reporting Forms and Procedures.

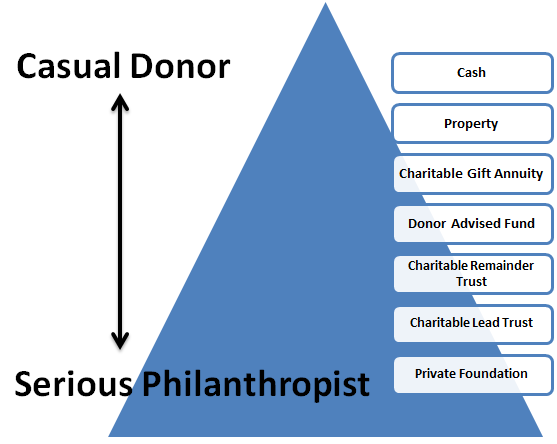

A charitable lead trust pays an annuity or unitrust interest to a designated charity for a specified term of years the charitable term with the remainder ultimately distributed to non-charitable beneficiaries. For example in recent times crowdfunding campaigns have become a popular way to raise money for charitable causes. A Charitable Remainder Unitrust CRUT pays out a fixed percentage of the trust value each year.

Federal Tax Exempt Status. A deductible gift recipient DGR is an organisation or fund that registers to receive tax deductible gifts or donations. The added increase in yields may serve as a hedge against inflation.

Tax Preparation Service Company Bond. For example a taxpayer sells their property to a charitable organization for 100000 but at the time of the transaction the fair market value of the property in question is 200000 and. Under the Coronavirus Aid Relief and Economic Security CARES Act you can deduct up to 100 percent of your charitable cash contributions to qualifying charities.

As with all annuity types indexed annuities are tax-deferred products. Tax Preparation Service Companies. Commonly accepted way of recording and reporting accounting information and includes the income statement the balance sheet and the cash flow statement.

From a fiscal perspective the tax breaks are a huge advantage to making a planned giving arrangement. The amount will be recalculated each year and the Lead Beneficiaries receive larger payments that year if the CRUTs rate of return exceeds the fixed percentage payout and smaller payments that year if the CRUTs rate of return is less than the fixed percentage payout. Charitable Trusts Charitable Lead Trust.

A type of gift transaction in which a donor contributes assets to a charitable trust which pays an annuity designed to leave a substantial proportion of the. Charitable gift annuity occurs when a donor makes an agreement with a nonprofit. When stocks in your index such as the SP 500 increase in value the value of your contract increases.

Tracking planned giving data and reporting updates to board. For a sample form of a trust that meets the requirements of a testamentary charitable lead annuity trust see Rev. Charitable Remainder Annuity Trust.

Not all charities are DGRs.

Charitable Gift Annuities Maryknoll Fathers Brothers

Life Income Plans University Of Maine Foundation

Tools Techniques 101 The Charitable Gift Annuity Withum

City Of Hope Planned Giving Annuity

Charitable Gift Annuities Development Alumni Relations

Charitable Gift Annuities 1 Introduction Youtube

Charitable Remainder Annuity Trust Planned Giving Case Western Reserve University

Gifts That Pay You Income Fred Hutchinson Cancer Research Center

Charitable Gift Annuity Boys Girls Clubs Of Palm Beach County

Red Clay Creek Presbyterian Church Wilmington De Charitable Gift Annuity How It Works

Charitable Gift Annuity Claremont Mckenna College

Charitable Gift Annuities Uses Selling Regulations

9 Taxation Of Charitable Gift Annuities Part 4 Of 4 Planned Giving Design Center

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center