ny paid family leave tax 2021

The Paid Parental Leave negotiated by CUNY and. Eligible employees will contribute.

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits.

. Asian virgin girls deflowered. The payroll deduction for 2021 set by New York State is 0511 of salary capped at a maximum deduction of 38543 per year. March 10 2021 update.

Ny paid family leave tax 2021. Employers may collect the cost of Paid Family Leave through payroll deductions. The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum.

Paid Family Leave has tax implications for New York employees. The maximum annual contribution is 42371. New York Paid Family Leave Resource Guide.

What Is Ny Paid Family Leave Tax. Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will. For 2023 the NYSAWW is 168819 which means that the maximum weekly benefit for 2023 is 113108 a 6272 increase from 2022.

On December 23 2020 the Office of the State Comptroller issued State Agencies Bulletin No. 2021 was the final phase-in of the program to full implementation. Pursuant to the Department of Tax Notice No.

The New York State Department of Financial Services has announced the contribution rate and benefit schedule under the New York Paid Family Leave PFL law effective January 1 2021. 1 2021 New York Governor Kathy Hochul signed an amendment to the New York Paid Family Leave Benefits Law the PFL expanding the definition of family. 2021 New York Paid Family Leave PFL Rate and Benefit Amounts.

Your employer will deduct premiums for the Paid Family Leave program from your. Sda leadership manual pdf san sebastian spain map victoria traffic accident report klock werks windshield 2013 road glide. From these covered employers employers may voluntarily offer this leave as of January 1 2021 after an employee takes leave for 10 days unpaid for up to 10 weeks for reasons related to.

Ad Download or Email NY PFL-1 Form More Fillable Forms Register and Subscribe Now. With the passing of the American Rescue Plan of 2021 emergency sick and family leaves have been extended until the end of September 2021This. In New Jersey go to.

In 2022 the employee contribution is 0511 of an employees gross wages each pay period. The Department of Financial Services DFS set the NY PFL rate and benefit amounts for 2021 as. 1887 to inform agencies of the 2021 rate for the New York State Paid.

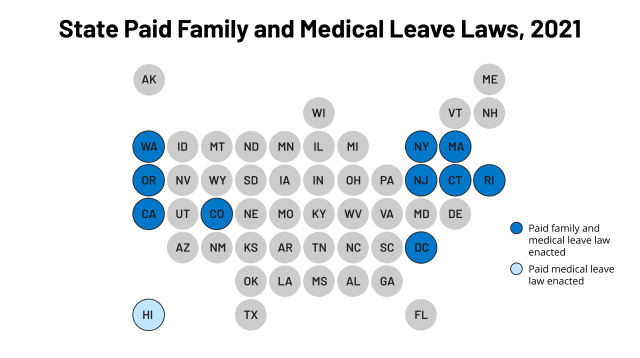

Time Off To Care State Actions On Paid Family Leave

2021 State Paid Family And Medical Leave Contributions And Benefits Mercer

New York State Paid Family Leave Cornell University Division Of Human Resources

Is Paid Family Leave Taxable Marlies Y Hendricks Cpa Pllc

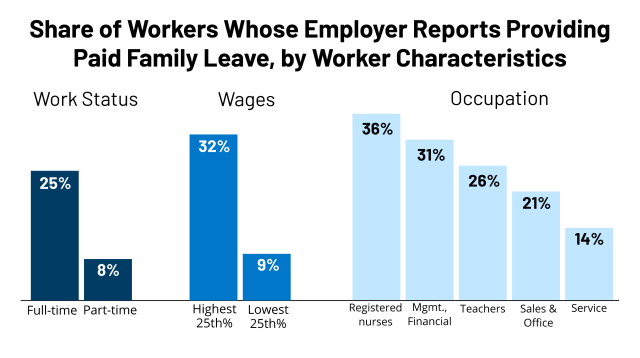

Explainer Paid Leave Benefits And Funding In The United States

Paid Parental Leave Around The World And How The U S Compares The Washington Post

Cost And Deductions Paid Family Leave

New National Paid Leave Proposals Explained

Paid Family Leave Gets Slashed As Democrats Try To Reach Consensus On Spending Plan Npr

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

New York State Paid Family Leave Law Guardian

Time Off To Care State Actions On Paid Family Leave

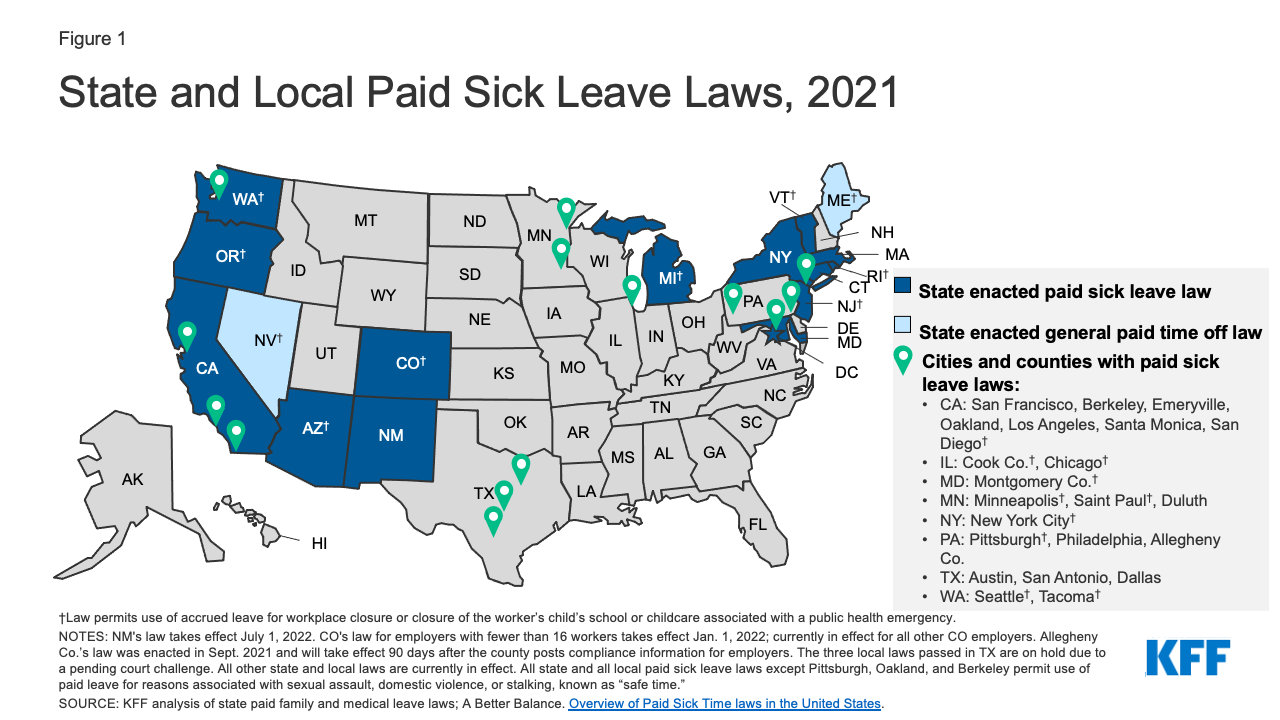

Universal Paid Family And Medical Leave Under Consideration In Congress Kff