capital gains tax increase effective date

If adopted this proposal would likely be effective December 31 2021. However some of the proposed tax law changes for example higher capital gains rates on the sale of an asset could be made effective to an earlier date such as the date of the enactment of the new tax legislation.

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

The House bill would apply the increase to gain recognized after September 13 2021.

. Details of the tax rate changes. The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept. The current three-year holding period rule would continue to apply for real property trades or businesses and taxpayers with adjusted gross income less than 400000.

The NYC rate remained at 3876. Increase holding period to receive long-term capital gain treatment for carried interest from three to five years effective December 31 2021. With tax writers launching mark-ups as early as Sept.

Ii The Presidents plan you may recall would make the increased capital gains rate effective after April 2021. 1 2022 with some exceptions he said. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of.

Today youll find our 431000 members in 130 countries and territories representing many areas of practice including business and industry public practice government education and consulting. Some commentators suggest that a more likely scenario is that any increase in the capital gain tax rate will become effective on the date the bill is introduced or passed. Ive always been thinking in discussing Biden tax policy assuming we have legislative activity this year we would be looking at an effective date of Jan.

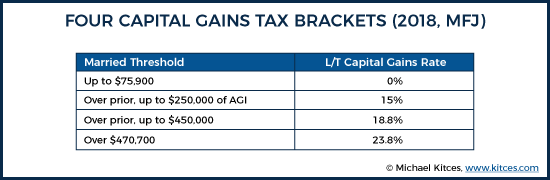

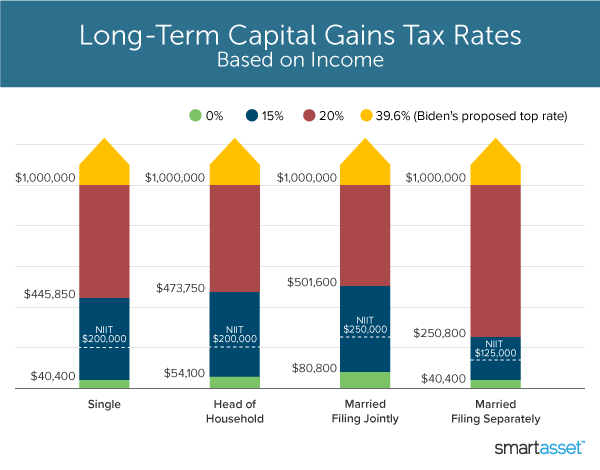

Other tax increases are expected as well including increased social security taxes and capital gains rates on income above 400000 and 1 million respectively. The table also shows the inclusion Eligible. This timing suggests there may be a window to recognize embedded gains at current rates before a.

Appendix Top 2020 marginal tax rates for capital gains and dividends The following table illustrates the current top marginal tax rate on capital gains by provinceterritory as well as the potential top marginal tax rate on capital gains if the inclusion rate increases to 66 2 3 or 75. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. Our history of serving the public interest stretches back to 1887.

Taxpayers should consult with their income tax and estate planning advisors to determine the appropriate response to these potential changes. The 1987 capital gains tax collections were slightly below 1985. This resulted in a 60 increase in the capital gains tax collected in 1986.

This proposal would be effective for gains required to be recognized after the date of announcement according to Treasury Department materials released Friday afternoon. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long-term capital gains was increased from 20 in 1986 to 28 in 1987. The House Ways and Means Committee released their tax proposal on September 13 2021A summary can be found here and the full text hereThe proposal would increase the maximum stated capital gain rate from 20 to 25.

13 2021 unless pursuant to a written binding contract effective on or before Sept. More than five months ago. 27 deadline there could be imminent action triggering an effective date tied to an upcoming date.

9 and racing against a Sept. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. And capital gains because they target sales and exchanges each one of those policies may be appropriate for an exception.

It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning. The current estimate of that effective date ranges from October 15 2021 on the early. The effective date for this increase would be September 13 2021.

This resulted in a 60 increase in the capital gains. Bidens plan would raise the top tax rate on capital gains to 434 from 238 for households with income over 1 million. The proposal would be effective for gains recognized after the undefined date of announcement which could be interpreted as the April 28 2021 date of the release of the American Families Plan or the May 28 2021 date of the release of the Greenbook itself.

Iii From a top individual rate of 882 to rates ranging from 965 to 109. President Joe Bidens proposed budget for the upcoming fiscal year assumes that a hike in the capital-gains tax rate took effect in late April meaning that it. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of revenue.

We are the American Institute of CPAs the worlds largest member association representing the accounting profession. Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. Generally the proposed effective date for any enacted tax law changes is expected to be January 1 2022.

Due Dates Income Tax Return Due Date Taxact

What Is The 2 Out Of 5 Year Rule

Pin By Karthikeya Co On Tax Consultant In 2020 Monday Tuesday Sunday Monday Tuesday Thursday Friday

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

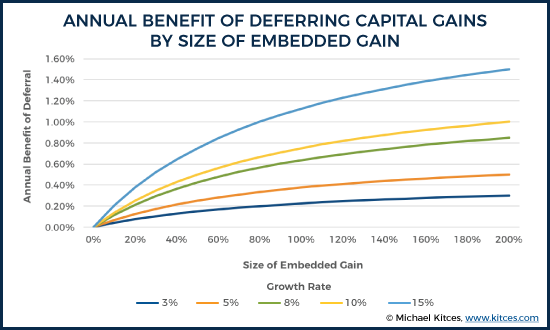

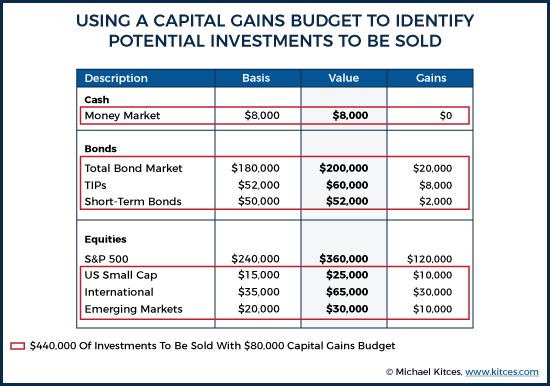

Strategies For Investments With Big Embedded Capital Gains

Checklist Of Documents For Filing Income Tax Return Tax Checklist Income Tax Income Tax Return

Strategies For Investments With Big Embedded Capital Gains

Due Dates Advance Tax Payments Tax Payment Tax Deducted At Source Due Date

Ministry Of Corporate Affairs Mca All About E Filing Income Tax Return Income Tax Types Of Taxes

Are My Capital Gains Recognized On The Trade Or Settlement Date Qsbs Expert

What S In Biden S Capital Gains Tax Plan Smartasset

How To Calculate Capital Gains Tax H R Block

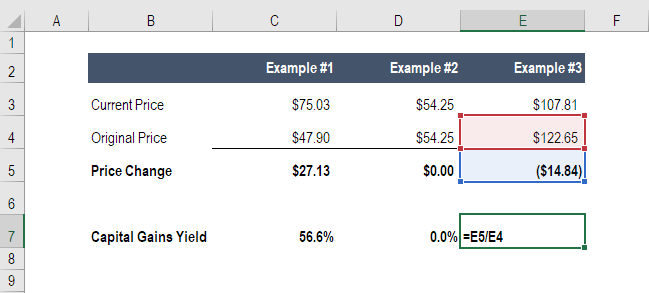

Capital Gains Yield Cgy Formula Calculation Example And Guide

Harpta Maui Real Estate Real Estate Marketing Taxact

Learn How You Can Claim Tax Credit For Investments In Shares For Savings Filing Taxes Tax Credits Tax Services

Capital Gains Tax Spreadsheet Shares Capital Gains Tax Capital Gain Spreadsheet Template